Senior Risk Officer

We’re seeking a proactive Senior Risk Officer to assist the Head of Risk in developing and sustaining a solid, actionable risk management framework. This position combines in-depth expertise in EU regulations with excellent project management to convert policies into practical processes, dashboards, and decision-support tools. You will oversee risk projects from start to finish, track essential metrics and thresholds, handle regulatory processes, and help resolve audit findings and oversight requirements firm-wide.

Duties and Responsibilities

- Update the Risk Management Policy, Trading Book & Hedging Policy, and associated procedures.

- Aid the annual ICARA process, covering capital/liquidity reviews, stress tests, wind-down evaluations, and related records.

- Manage DORA tasks like ICT risk logs, incident tracking, and vendor oversight.

- Oversee exposure monitoring, limit adherence, exception records, and escalation handling.

- Analyze risk indicators and prepare stress/scenario reports with insights for leadership.

- Manage the incident log, action tracking, closure verification, and owner follow-ups.

- Perform third-party risk reviews for banks, liquidity providers, brokers, and key suppliers, plus outsourcing records.

- Track all risk projects on policies, audits, fixes, and tech, ensuring deadlines are met.

- Align deliverables from Dealing, Compliance, Finance, and IT with clear timelines and escalations.

- Develop content for Risk Committee and Board sessions on major risks, violations, KRI patterns, and regulatory changes.

- Organize an evidence library with workpapers, version tracking, and approvals.

Requirements

- Fluent English.

- 3–6 years in risk or audit at a regulated financial institution, preferably with CySEC or ESMA experience.

- Familiarity with ICARA (IFR/IFD), MiFID II, EMIR, and DORA basics.

- Solid foundation in finance, equities, accounting, probability, statistics, time-series data, market dynamics, and introductory derivatives.

- Proven project management, including planning, stakeholder coordination, and timely execution.

- Advanced Excel for data organization and metric validation.

- Strong written communication and consistent documentation practices.

Benefits

- Competitive salary tailored to experience and skills.

- Private medical insurance starting day one.

- Professional growth via internal and external training.

- Sports programs.

- Team-building and company events.

- Vibrant, collaborative atmosphere with great team energy.

- Flexible Monday–Friday hours: any 8-hour shift from 08:00–18:00.

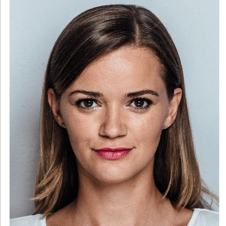

Advance Your Risk Management Career in a Diverse and Inclusive Environment

We value diversity, equity, and inclusion in our workplace. We encourage applications from talented individuals of all backgrounds, experiences, and identities. Your unique skills and perspectives will contribute to smarter decision-making and stronger outcomes for our stakeholders and clients. Bring your authentic self and be part of our journey as we raise standards of risk excellence together.

- Locations

- Limassol, Cyprus

About Salve.Inno Consulting

Bringing a personalized approach to connecting exceptional talent with unique opportunities. Specializing in recruitment for diverse roles, leveraging extensive experience and innovative strategies to find the perfect match for any business needs. Collaboration builds a stronger, more successful future – one strategic hire at a time.